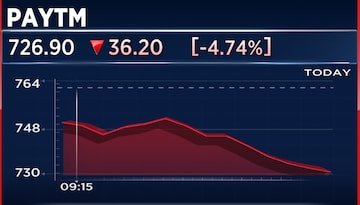

Shares of One97 Communications Ltd., the parent company of payments aggregator Paytm, are trading with losses of 6% on Thursday, March 20, and are among the top losers on the Nifty 500 index.

A couple of brokerage firms have suggested ‘Neutral’ or ‘Hold’ ratings on the Paytm stock, saying they will remain watchful on the challenging macro-environment, traction in the financial distribution business and near-term UPI market share.

Global brokerage firm Jefferies has maintained a ‘Hold’ rating on the stock, with a price target of ₹850 per share. This target implies a potential upside of 11% from the stock’s last closing price.

The foreign brokerage mentioned in its note that the government’s incentive of ₹1,500 crore for low-value UPI P2M transactions are half of last year’s and are, thus, negative for the company.

Jefferies expects incentives to fall from 20 basis points to 6 basis points. Additionally, it said that if the company’s incentives fall proportionately, its FY25 adjusted EBITDA could be 50% below estimates.

For FY26-27, EBITDA may be 20-30% lower, while profit before tax could be 15% lower in FY25, the brokerage said.

Jefferies will watch for a potential shift to MDR-based charges for large merchants. It said that such a switch could lift profits and improve predictability.

Motilal Oswal has a ‘Neutral’ rating on Paytm, with a price target of ₹870 per share.

The brokerage said that Paytm’s strategic focus on financial services business and cost optimisation should boost profitability, with the financial business contributing 27% of revenue by FY28.

Cost reductions and an estimated 26% revenue CAGR from FY25-27E (₹11,400 crore by FY27E) will enable Paytm to achieve EBITDA breakeven in FY27E, it said.

Motilal Oswal expects the company to gain traction in new customer onboarding and grow its MTU base, which will enable healthy cross-selling. Meanwhile, growth in the merchant business will remain the key profitability driver in the near term.

The brokerage also said that Paytm’s exploration of global markets, albeit with limited capital commitment, and its strong cash position (₹12,850 crore in Q3FY25) further provide comfort.

Additionally, the potential introduction of MDR on UPI could significantly boost Paytm’s revenue and incentivise the company to push for market share gains in consumer payments. Furthermore, the recent SEBI approval for Paytm Money to expand into investment insights and research services presents an opportunity to diversify into wealth management, potentially unlocking a new stream of fee-based income.

Shares of Paytm are currently trading 4.22% lower on Thursday at ₹731.50. The stock is still down 26% so far this year. The stock is still down 64% from its IPO price of ₹2,150 per share.

Content retrieved from: https://www.cnbctv18.com/market/paytm-share-price-skids-as-jefferies-flags-risks-to-its-adjusted-earnings-before-tax-19576358.htm.