Paul Graham, co-founder of Y Combinator, stirred an online storm recently with his phrase ‘founder mode’, which described a way of running a company different from ‘manager mode’. There was also the ‘monk mode’, recommended by the founder and CEO of Wyndly, last year.

Now, Aswath Damodaran, a Professor of Finance at the Stern School of Business at New York University, famous for his philosophies on valuations has adapted the popular phrase ‘sugar daddy’ into the world of finance.

For the uninitiated, a sugar daddy is a rich, older man who showers young women with money and gifts for her company, friendship, love, and/or sex. The valuations Guru believes something similar is at play in the world of venture capital too.

According to celebrated author, the sugar daddy effect would explain why Google’s venture investments paid off and that of SAP didn’t.

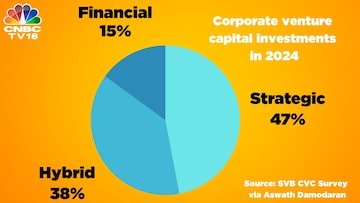

In an article published on his LinkedIn account on October 29, Damodaran argues that even the largest of entities like sovereign wealth funds and venture funds backed by big corporations make less diverse bets due to a lack of independence from the parent or the government that provides the money.

The priorities of the parent, where the money comes from, continue to affect, as Professor Damodaran put it, ‘what they invest in and how much’. The data was shared by the valuations Guru at Stern School of Business on October 29, 2024.

“There are relatively few firms, where there is a corporate venture capital (CVC) arm or division, that is in charge of, and accountable for, CVC investments,” he added citing the example of Google, which benefited from betting outside its comfort zone in startups like Uber, Airbnb, and Slack early in the lifecycle of each startup.

On the other hand, tech giant SAP had to shut down its venture arm this year after the startups backed by the software giant had raised over $12.9 billion over seven years.

CVCs accounted for over half of all venture investments in the world in 2023. According to the professor, they have punched well below their weight, collectively.

Damodaran’s argument is that it has particularly affected investments outside fossil fuels. A lot of money has gone into solar, wind and hydro energy and only a small slice has gone into nuclear energy and other low-emissions fuels because the impact investors ‘want to have their cake i.e. market-beating returns, and eat it too’. This directly impacts the efforts taken to battle climate change.

“In October 2024, had a collective market capitalization of $506 billion and they reported aggregated revenues of $117 billion in the most recent twelve months. In contrast, just one fossil fuel company, Exxon Mobil alone had a market capitalisation of $532 billion and revenues of $479 billion,” Damodaran said arguing for greater independence for the fund managers, clear and unconflicted purpose, and the willingness to pull the plug on the part of the parent.

Content retrieved from: https://www.cnbctv18.com/business/startup/aswath-damodaran-sugar-daddy-effect-in-venture-capital-sovereign-wealth-funds-and-climate-change-19500664.htm.